| Vehicle Highlights | SELECT | PREMIUM | GT | Mustang Mach-E® Rally |

| Max Seating Capacity | 5 | 5 | 5 | 5 |

| Electric motor(s) | Primary eMotor (Rear) [Available Dual eMotor (Front/Rear)] | Primary eMotor (Rear) [Available Dual eMotor (Front/Rear)] | Dual eMotor (Rear/Upgraded Front) | Dual eMotor (Rear/Upgraded Front) |

| Drive Type | RWD (available eAWD) | RWD (available eAWD) | eAWD | eAWD |

| Battery Type | Standard Range (Usable Battery Capacity 73kWh) Available Extended Range (Usable Battery Capacity 88kWh) | Standard Range (Usable Battery Capacity 73kWh) Available Extended Range (Usable Battery Capacity 88kWh) | Extended Range (Usable Battery Capacity 91kWh) | Extended Range (Usable Battery Capacity 91kWh) |

| Front Trunk (cu. ft.) | 2.6 cu. ft | 2.6 cu. ft | 2.6 cu. ft | 2.6 cu. ft |

| Base Vehicle Warranty | 3 years / 36,000 bumper to bumper warranty | 3 years / 36,000 bumper to bumper warranty | 3 years / 36,000 bumper to bumper warranty | 3 years / 36,000 bumper to bumper warranty |

| Warranty | Battery is covered for 8 years or 100,000 miles, whichever comes first, retaining a minimum of 70% of its original capacity over that period.* | Battery is covered for 8 years or 100,000 miles, whichever comes first, retaining a minimum of 70% of its original capacity over that period.* | Battery is covered for 8 years or 100,000 miles, whichever comes first, retaining a minimum of 70% of its original capacity over that period.* | Battery is covered for 8 years or 100,000 miles, whichever comes first, retaining a minimum of 70% of its original capacity over that period.* |

| *See your dealer and the Battery Electric Vehicle Warranty Guide for limited warranty details. | ||||

2026 Mustang Mach-E®

As Shown Price

Electric in Every Sense of the Word

Models

The Power to Be You

Define what drives you. Drive what defines you. Whether you prefer the simplicity of Select, the range of Premium, the freakishly fast 0–60 of GT, or the off-pavement capability of Rally, the Mustang Mach-E® SUV favors bold self-expression.

360 Viewer

Do a Donut Without Burning Rubber

Customize

Ready. Set. Roam Free.

Design

A Harmonious Paradox

Family-friendly practicality. Sports car style and exhilaration. The 2026 Mustang Mach-E® makes contradictions complement each other.

Storage in Unexpected Places

Back

Get up to 59.7 cu ft * of space behind the front seats when you fold down the second row.

Center

Find room within arm’s reach. You’ve got two front-seat cupholders and an overhead sunglasses holder. Also, find out-of-sight compartments in the center console, under the armrest, and in the pass-through cubby.

Front

Sweaty gym gear? Birthday presents for the kids? The available frunk can keep funky smells and valuables under wraps. It’s also drainable. Add ice and use it as a cooler, or rinse it clean after transporting muddy hiking boots.

Gallery

Jaw, Meet Floor

Test Drive

A Quiet Ride That Speaks Volumes

Technology

Intuitive, Not Robotic

Access some of your favorite apps wirelessly with Apple CarPlay® and Android Auto™ compatibility. 161 More than one driver? Switch quickly between multiple synced phones to personalize every drive.

Access Connected Navigation, Alexa Built-in, and an unlimited 5G Wi-Fi® hotspot.* Break time? Show off your pipes with karaoke, or stream YouTube on the 15.5" center display while parked. 24

Feel confident in a busy and distracted driving world with a rearview camera, Lane-Keeping System, * and Auto High-Beam Headlamps. 10

BlueCruise

Arrive Energized

Available with the Technology Package, BlueCruise hands-free highway driving with Automatic Lane Change helps make driving easier and more enjoyable. 12

Specs

Fast Facts

Battery Type

-

Standard-range battery (73 kWh) or available extended-range battery (88 kWh)

EPA-Estimated Range 171

-

260 miles with standard-range battery and RWD

240 miles with standard-range battery and eAWD

300 miles with extended-range battery and eAWD

Standard-Range Battery Charge Time *

-

RWD: 7.8 hours with 48-amp charger and 240V outlet

eAWD: 7.7 hours with 48-amp charger and 240V outlet

Horsepower †

-

264 horsepower with standard-range battery and RWD

325 horsepower with standard-range battery and eAWD

370 horsepower with extended-range battery and eAWD

Torque 70

-

387 lb-ft of torque with standard-range battery and RWD

500 lb-ft of torque with standard-range battery and eAWD

500 lb-ft of torque with extended-range battery and eAWD

Seating Capacity

-

5

Battery Type

-

Standard-range battery (73 kWh) or available extended-range battery (88 kWh)

EPA-Estimated Range 171

-

260 miles with standard-range battery and RWD

240 miles with standard-range battery and eAWD

320 miles with extended-range battery and RWD

300 miles with extended-range battery and eAWD

Standard-Range Battery Charge Time *

-

RWD: 7.8 hours with 48-amp charger and 240V outlet

eAWD: 7.7 hours with 48-amp charger and 240V outlet

Horsepower †

-

264 horsepower with standard-range battery and RWD

325 horsepower with standard-range battery and eAWD

272 horsepower with extended-range battery and RWD

370 horsepower with extended-range battery and eAWD

Torque 70

-

387 lb-ft of torque with standard-range battery and RWD

500 lb-ft of torque with standard-range battery and eAWD

387 lb-ft of torque with extended-range battery and RWD

500 lb-ft of torque with extended-range battery and eAWD

Seating Capacity

-

5

Battery Type

-

Extended-range battery (91 kWh)

EPA-Estimated Range 171

-

280 miles with extended-range battery and eAWD

Standard-Range Battery Charge Time *

-

eAWD: 9.9 hours with 48-amp charger and 240V outlet

Horsepower †

-

480 horsepower with extended-range battery and eAWD

Torque 70

-

600 lb-ft. of torque with extended-range battery and eAWD

700 lb-ft of torque with extended-range battery and eAWD (Mustang Mach-E GT™ Performance Upgrade)

Seating Capacity

-

5

Battery Type

-

Extended-range battery (91 kWh)

EPA-Estimated Range 171

-

255 miles with extended-range battery and eAWD

Standard-Range Battery Charge Time *

-

eAWD: 9.9 hours with 48-amp charger and 240V outlet

Horsepower †

-

480 horsepower with extended-range battery and eAWD

Torque 70

-

700 lb-ft of torque with extended-range battery and eAWD

Seating Capacity

-

5

FAQ

Spark Your Curiosity

What is the 0–60 for the 2026 Ford Mustang Mach-E®?

0-60 MPH times for the Mustang Mach-E® SUV vary significantly by trim. The available Ford Mustang Mach-E GT™ Performance Upgrade on the Mustang Mach-E® GT model is the fastest at 3.3 seconds, while the Mach-E Rally is 3.4 seconds. Other trims achieve around 4.8–5.6 seconds, depending on the powertrain and battery.

Quick Comparison of 0-60 Times by Trim

Mustang Mach-E® GT model with available Mustang Mach-E GT™ Performance Upgrade: 3.3 seconds

Standard GT model: 3.8 seconds

Rally model: 3.4 seconds

Select and Premium models with standard-range battery and RWD: 5.6 seconds

Select and Premium models with standard-range battery and eAWD: 4.6 seconds

Premium models with extended-range battery and RWD: 5.4 seconds

Select and Premium models with extended-range battery and eAWD: 4.2 seconds

Factors Influencing 0-60 Times

Trim Level: The specific trim plays a role in the vehicle's acceleration capabilities

Performance Upgrades: The Mustang Mach-E® GT™ Performance Upgrade can significantly increase the 0–60 time

Battery Options: Extended-range battery models have faster 0-60s than standard-range

Drivetrain: All-wheel-drive (AWD) configurations provide better acceleration than rear-wheel-drive (RWD)

Testing Conditions: Variables like weather, road conditions, tire types, and more can impact acceleration

What is the horsepower for the 2026 Ford Mustang Mach-E?

The Ford Mustang Mach-E delivers between 264 and 480 horsepower, depending on the trim and configuration. Factors like battery and drivetrain will affect the horsepower. At the top end, the GT and Rally models produce up to 480 horsepower. 70

Does the 2026 Ford Mustang Mach-E have AWD or 4WD?

The Mustang Mach-E® offers three drivetrain options: RWD, eAWD, and the GT enhanced eAWD.

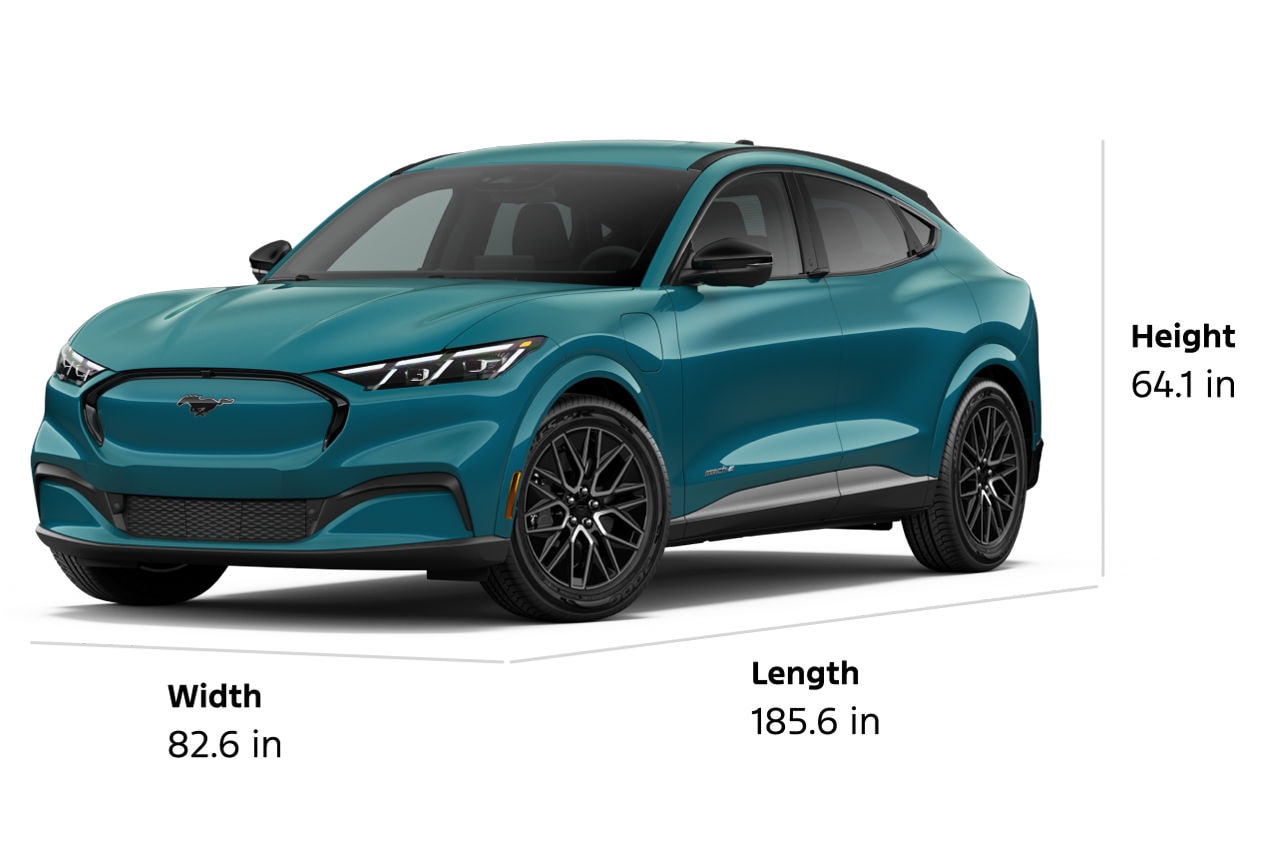

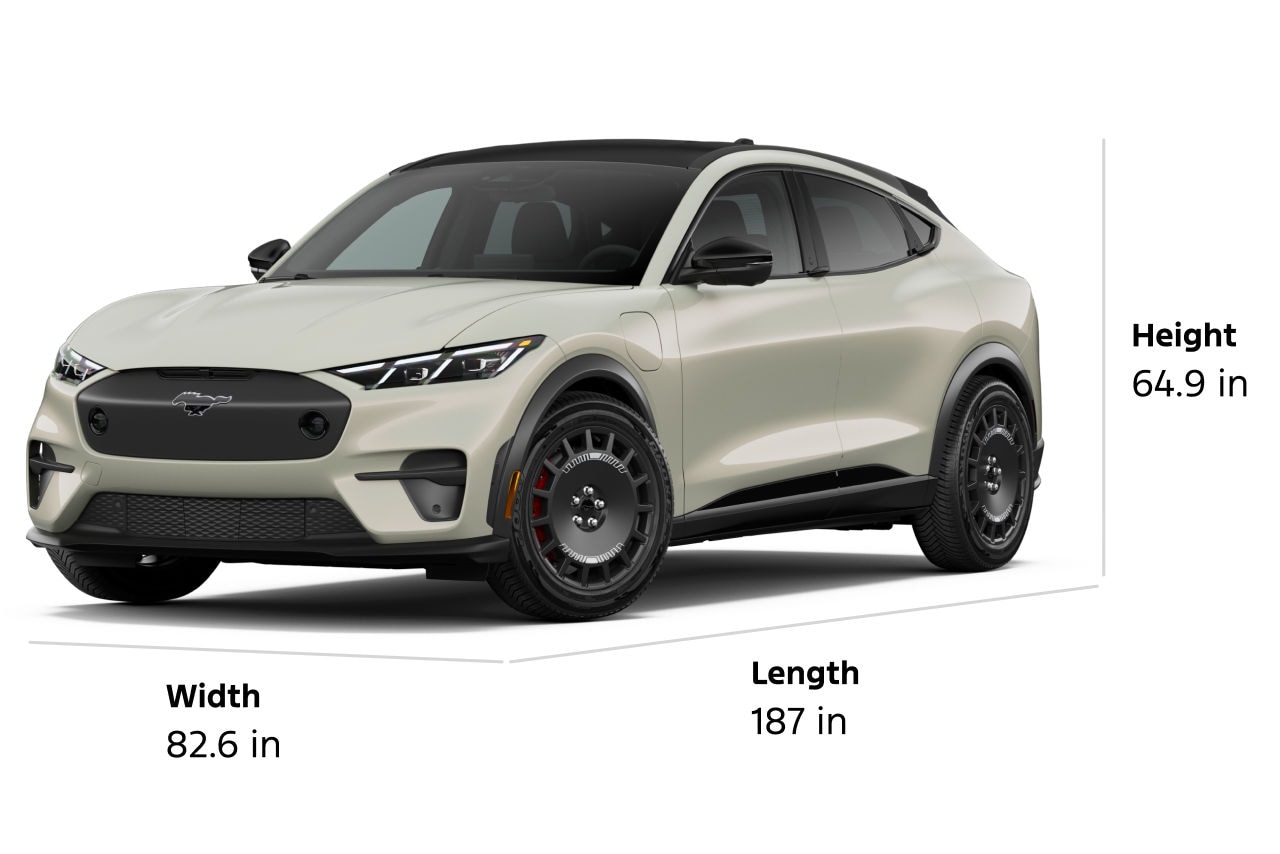

What are the dimensions of the 2026 Ford Mustang Mach-E?

The dimensions of the 2026 Mustang Mach-E Premium model are as follows:

Length: 117.5"

Overall width with mirrors: 82.6"

Overall width without mirrors: 74.1"

Height: 64.1"

Wheelbase: 117.5"

Cargo capacity: 29.7 cu. ft. behind the second row

Maximum cargo capacity: 59.1 cu. ft. behind the first row

Measurements vary by model. To find the length, width, and height of another model, please refer to the Specs section above.

What’s new on the 2026 Ford Mustang Mach-E?

The following features are new for the 2026 model year:

GT Performance & Handling Package

California Special Package

Ford Security Package

Technology Package

Panoramic Roof Package with removable sunshade

Rear grabber handles

Clear Exit Assist

Available three-year plan for Sirius XM with 360L *

Race Red and Adriatic Blue exterior colors (extra-cost colors)